Contact:

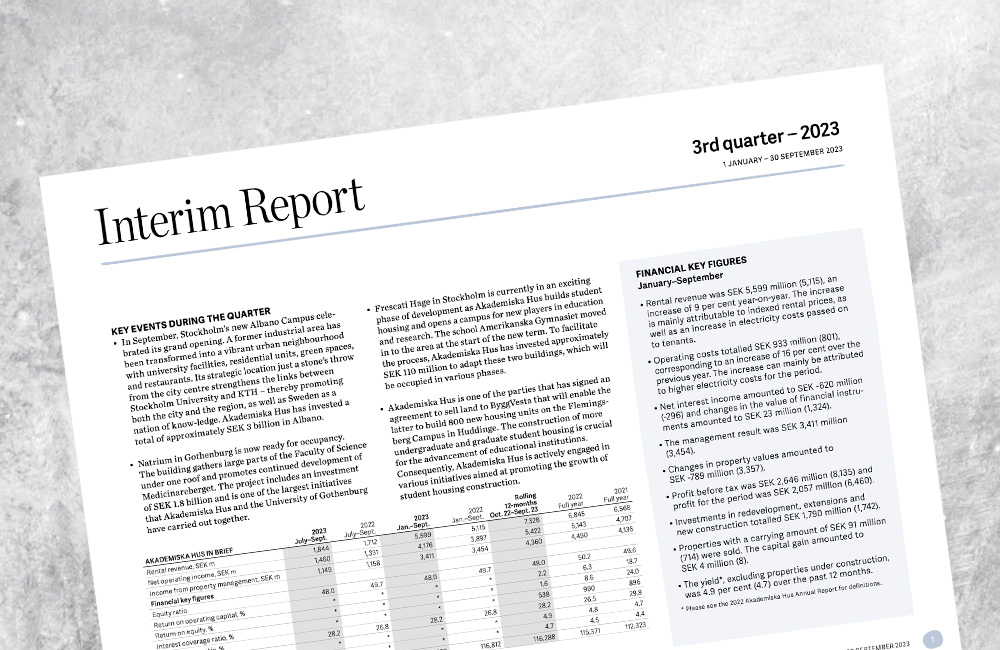

Akademiska Hus Interim Report 1 January–30 September 2023: Strong net operating income and stable property values

Tuesday, 24 October 2023

The Interim Report in brief:

- Rental revenue was SEK 5,599 million (5,115).

- Net operating income amounted to SEK 4,176 million (3,897).

- Net interest income amounted to SEK -620 million (-296) and changes in the value of financial instruments amounted to SEK 23 million (1,324).

- Income from property management was SEK 3,411 million (3,454).

- Changes in the value of properties totalled SEK -789 million (3,357).

- Pre-tax profit for the period was SEK 2,646 million (8,135).

- Investments in redevelopment, extensions and new construction totalled SEK 1,790 million (1,742).

- Properties with a carrying amount of SEK 91 million (714) were sold.

- The yield (excluding properties under construction and expansion reserves) was 4.7 per cent (4.6) over the past 12 months.

“In line with our expectations, we have maintained our AA rating from Standard & Poor’s, a level we have held since 1996. This financial stability will enable us to develop and maintain our properties at the same high standards as before, despite challenging times,” says Caroline Arehult, CEO of Akademiska Hus.